Normally when you buy a stock, you have to buy an entire share. So if you wanted to buy Tesla trading today at $736.27, you had to have at least $736.27. With fractional shares, you can buy a smaller sliver for as little as a dollar.

How can I save on taxes?

The best way to save on taxes is through special investment accounts like a 401K, IRA, Roth IRA, HSA, and 529. They let your money grow tax-free and some even let you take your money out tax-free.

Where should I put money that I’ll need soon?

In a savings account. Any investment account runs the risk of losing value over the short-term. If you don’t need the money for three or more years, you should consider an investment account.

What kind of life insurance should I get?

Term life insurance. You buy a policy for a fixed amount of time and you pay a fixed rate depending on how much of payout you’re buying.

What is mortgage insurance?

If you put down less than a 20% down payment when buying a home, the lender will require you to have mortgage insurance to protect them in case you end up not paying your mortgage. If you bought a $500,000 home, you would have to pay around $7,500 for mortgage insurance.

When should I take Social Security?

If you can, you should wait until you’re 70. You’ll lose almost 30% if you take it when you’re 62. You can think of it as a great insurance plan that you’ll have for the rest of your life.

What is an annuity?

Usually, a ripoff. You hand over a giant lump sum of cash and they’ll guaranty payments for life when you retire. But annuity companies need to make money too, so they’ll keep those payments to a minimum.

What happens to money in my 529 Plan if my kid gets a scholarship?

If junior gets that full ride to Stanford, you will not pay a withdrawal penalty on the 529 money that you normally would for the amount of the scholarship. You just pay income tax on the money that was earned on the investments.

What are capital gains?

Capital gains is the money you make when you sell a stock for more than what you bought it for. If you have owned the stock for more than 1 year, you’ll pay lower taxes on this money.

What are dividends?

Dividends are cash that a company pays to anyone who owns their stock every 3 months. For example, Apple recently paid a $0.22 dividend per share, with each share costing $128.

Should I invest in a Roth IRA or a Traditional IRA?

Go with a Roth if you’re single and make less than $85k/yr or married and make less than $170k.

Should I use a financial advisor?

No. If you’re rich, maybe.

What is an ETF?

It’s basically a mutual fund. Just ignore them and invest in low-cost index mutual funds.

What is a stock?

A stock is an ownership slice of a company. When you own part of a company, you can earn money when the company shares some of its profits and you can sell your ownership for more money if the company has been successful.

What is compounding?

It’s as if your money was like a pair of bunnies, who have babies, who have babies, who have babies …. Your money grows fast because the money it makes, makes more money. A giant, green, money snowball.

Should I invest in Bitcoin? How about crypto?

No.

How much money can I make in the stock market?

On average, you can expect to earn 6%-8% every year in the stock market over long periods of time, but there are big ups and downs. You would have earned 29% in 2019, but lost 38% in 2008.

What is an expense ratio?

It’s the fee that a mutual fund charges you, every year, and you never even see the bill – they just take it directly out of your account. It’s shown as a small percentage, but it adds up to big bucks. If you have $100,000 in a mutual fund with 0.8% expense ratio, you pay $800 dollars per year.

What is dollar-cost averaging?

It’s a way to reduce your risk by adding your money to your investments over time. Rather than putting all your money in your account at once and risking that your investment drops the next day, you could invest a portion of your money every week or month.

Best Investment

With a Vanguard Target Date Fund you just choose the date closest to when you’ll need the money and the mutual fund automatically adjusts its risk across thousands of stocks and bonds from around the world.

Best Car Insurance

Progressive has Low rates, an easy-to-use app, and website.

Best Credit Card

With the Citi Double Cash Card you earn 2% cash back on all purchases with no annual fee.

Best Phone Plan

Visible offers unlimited voice and data for just $25/month, all fees included. You just need to get three other friends or family to join a group or you can find a group online. Visible uses the exact same network as Verizon.

Best Bank

Capital One consistently offers high-interest savings, no fees, 70,000+ fee-free ATMS, and has a great website and mobile app to let you easily manage your money.

Best Home Insurance

Hippo is the best insurance across price and service. They’ll send out a small kit of smart home devices like a water sensor and a smoke alarm sensor to further discount your costs.

Best Investment Firm

Vanguard tops all other investment firms because it offers the lowest costs across all its investments. Other companies may have a few low-cost options, but they’ll try to move you into their higher-cost stuff eventually. They pioneered the world’s best investment, the index fund, and they’ve been low-cost since they started in 1977.

Where should I put my next dollar? Start here.

If you’re lucky enough to have some money left over after paying all the bills, you may be wondering where’s the best place to put that money to work.

Dear Dollars Printable Card Set

Download this printable, print out your Dear Dollars card set, and figure out where to put your next dollar.

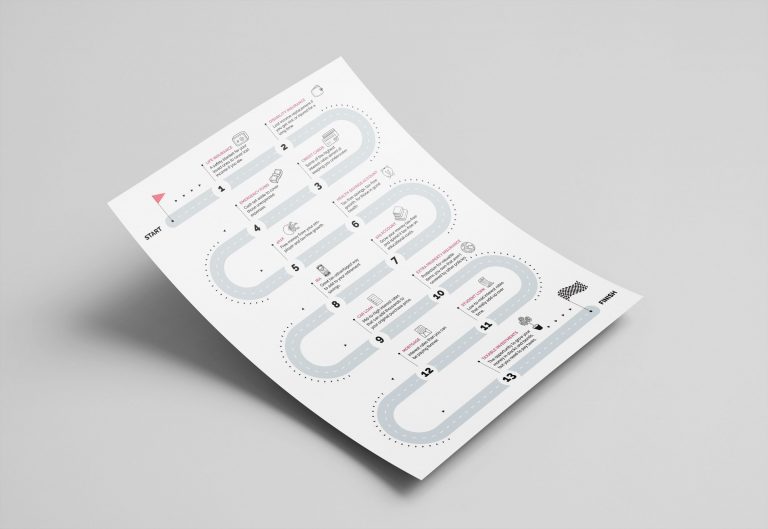

Dear Dollars Printable Roadmap

Download this printable to see the sequence of steps you should take to maximize your every dollar.

1. Life Insurance

Life insurance is a safety blanket for your loved ones to cover lost income in case you die. You should have 10X your annual income.