If you’re lucky enough to have some money left over after paying all the bills, you may be wondering where’s the best place to put that money to work.

Dear Dollars Printable Card Set

Download this printable, print out your Dear Dollars card set, and figure out where to put your next dollar.

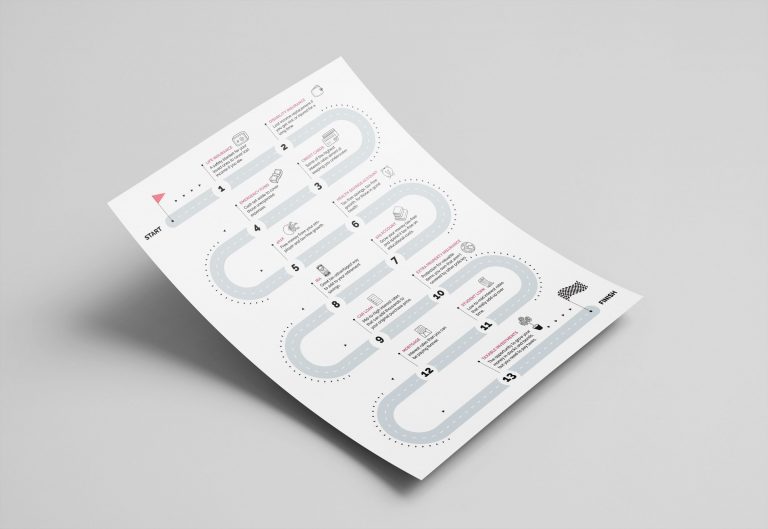

Dear Dollars Printable Roadmap

Download this printable to see the sequence of steps you should take to maximize your every dollar.

1. Life Insurance

Life insurance is a safety blanket for your loved ones to cover lost income in case you die. You should have 10X your annual income.

2. Disability Insurance

Disability insurance covers lost income replacement if you get sick or injured for a long time. You should cover 60% of your paycheck.

3. Credit Cards

Credit cards charge some of the highest interest rates aimed at keeping you under water. You should aim at paying off your remaining balance

4. Emergency Fund

Your emergency fund is cash set aside to cover those unexpected expenses. Experts recommend saving 6 months of living expenses.

5. 401K

401K retirement plans offer tax-free growth and typically FREE money from your employer. And you don’t get taxed on the money you put in.

6. HSA

An HSA is an investment account for your healthcare needs that offers tax-free savings, tax-free growth, and tax-free use.

7. 529 Account

529 plans enable you to grow your money tax-free and spend it tax-free on educational costs. You may also get a tax deduction on the money you add.

8. IRA

IRAs are great ways to add to your retirement savings. They come in two flavors, traditional and Roth, and both let your investments grow tax-free.

9. Car Loan

Car loans have mid-high interest rates that add thousands to your original purchase price. That budget car could end up costing you luxury prices.

10. Extra Property Insurance

Homeowner’s and renter’s insurance do not cover everything you own. For highly valuable items, like an engagement ring, you’ll need an extra insurance policy.

11. Student Loans

Student loans charge mid interest rates that can keep you paying off your college for years to come. You may be able to defer your payments and not owe more interest.

12. Mortgage

Because mortgage debt is commonly carried over 30 years, the amount interest you pay will be more than half of the amount you borrowed. If rates are much lower, you should refinance.

13. Taxable Investments

Taxable investments give you the opportunity to stay ahead of increasing prices by growing your money in stocks and bonds, but you need to pay taxes.