If you’re lucky enough to have some money left over after paying all the bills, you may be wondering where’s the best place to put that money to work.

Dear Dollars Printable Card Set

Download this printable, print out your Dear Dollars card set, and figure out where to put your next dollar.

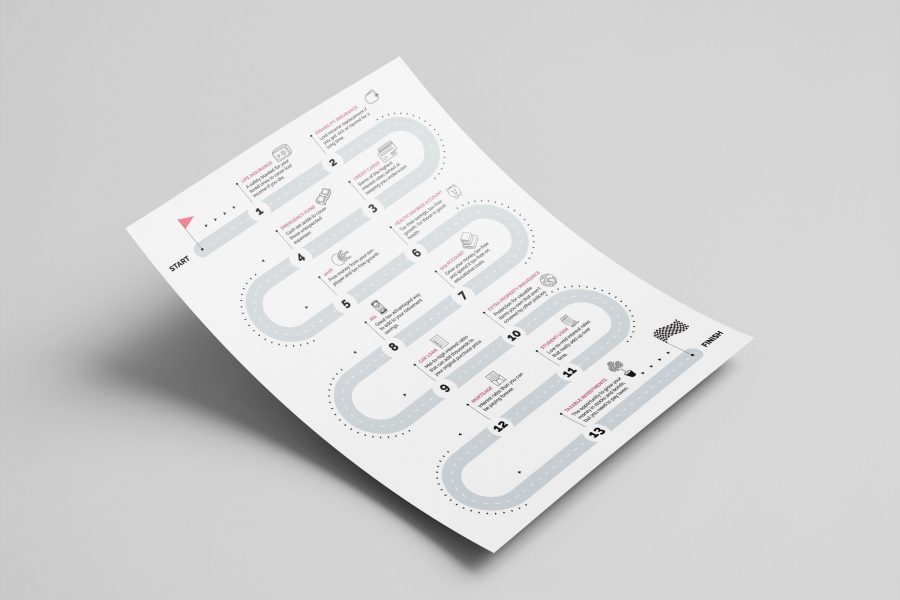

Dear Dollars Printable Roadmap

Download this printable to see the sequence of steps you should take to maximize your every dollar.

How much do mutual funds cost?

Mutual funds have a sneaky way to charge you with what they call an expense ratio. You never see a bill, they just take the money out of your account, like a boat with a leak in it. A 1% expense ratio will take 30% of your returns over 30 years (assuming a 6% annual return). You’d lose $142,154.88 over 30 years if you initially invested $100k. With a low-cost fund at 0.1%, you’d only lose $16,034.83 over 30 years.

Should I take my money out of the stock market when it drops?

No, you shouldn’t touch your money until you had originally planned to use it. And if it’s in the stock market, that should be a minimum of 5 years out. This is basically trying to time the market, which will burn you 99% of the time because you not only have to time it right when you take your money out, you have to time it right when you put your money back in. The biggest stock market climbs happen after the biggest falls, leaving you on the sideline.

Should my children open a bank account?

Yes. Set up a minor account that has zero monthly fees. This is a great way for kids to learn about money and saving!

What is a bond?

A bond is a loan to either a government or a company. They usually pay a fixed interest rate. Bonds are graded based on how trustworthy the company or government is to pay back its debts.

Should I pay off my mortgage early?

Paying off your mortgage early will give you a guaranteed return of your mortgage rate. But you should have an emergency fund and maximize your 401K and IRA contributions first.

How can I save for retirement if I own my own business?

You can establish a Solo 401k or a SEP IRA to save for retirement with great tax benefits. You can avoid paying income tax on the money you contribute today and the money grows tax-free. You only pay income tax when you take money out at retirement.

What’s the best way to avoid taxes when transferring wealth?

You can give anyone $15,000 a year tax-free. So if you and your wife have a child who is married with two kids, you can transfer $120,000/year to your child and family. Beyond that, you can create a trust pretty easily.

Why should I invest in index funds?

Index funds greatly reduce your investing risk. Rather than going all-in on a single bet, you can buy thousands of stocks and bonds in an index fund. You own each underlying stock or bond based on how much it’s worth, not on based on some “expert’s” guess. This lets you easily bet on the entire world economy, which is almost guaranteed to go up in the long run.

Should I pay off my credit card or my student loans?

Pay off your credit card debt first.

Should my teen have a credit card?

No. Instead, add them as an authorized user to one of your cards, but don’t give them a physical card. This will let them build a strong credit history by piggybacking off of yours. When they get to college, they should get their own credit card and they’ll be off to a great start.

What is the best credit card for points?

Instead of focusing on points, choose a cash-back card. Money today is better than points that you may forget to use or lose!

How can I reduce my homeowner’s insurance cost?

Bump up your deductible to as high as you can afford and you will get a big drop in your annual premium. Homeowner’s insurance should be your safety blanket for catastrophic damage. You shouldn’t use it for small claims because that will drive up your premiums.

Should I buy those extended coverage warranties?

No, they’re ripoffs. They try to play on your fear of something breaking, and when it does, the coverage stinks.

How can I save money on my energy bill?

Insulating your attic can cut your energy bill by up to 30%.

What’s the best way for me to save more money?

Attack the things you spend the most money on, often hidden in monthly payments. Cable and internet, cell phone, car insurance, home insurance. Set April 1st as your annual holiday where you price check these big expenses to avoid the big companies from “fooling” you.

How can I save money on my property tax?

Your property tax is based on the appraised value of your home. You can appeal the appraised value by presenting three appraised values of similar homes in your area to your local assessor’s office.

Should I buy a new or used car?

You should buy a used car that is two or three years old. You’ll still get the benefit of new technology, safety, and low maintenance but you don’t have to pay the hit of the initial drop in value when that new car was driven off the lot. This is even a bigger money saver when you are considering more expensive luxury cars.

Should I repair my car or get a new one?

If the repair costs less than half of your car’s value, you should repair it. Buying a car is expensive – even a used car. Don’t forget all the extras you’ll need to pay – like taxes, title, and maybe even more for insurance.

How should my kid start investing?

They should start with a Roth IRA. They’ll need to have income, but that could just be from babysitting or mowing the lawn. They need to keep track of the money they made.

Why should I invest? Can’t I just keep my cash under my mattress?

Investing is the best way to fight the ever-increasing price of everything. A movie ticket cost $2.89 in 1980 and today it cost $9.16. So if you had just put that $2.89 under your mattress in 1980 and pulled it out now to go to the movies, you’re out of luck. Investing grows your money to outpace the rise of prices.

What is a credit score?

It’s a way banks and other companies that lend money judge how trustworthy you are to pay them back. If you’re not that trustworthy, they’ll still lend you money but they’ll charge you a ton. If you borrowed money before and haven’t been good at paying money back – late or not at all – you’ll have a bad credit score.

Should I use my credit card or debit card?

Your credit card. All the major credit cards won’t make you pay for any fraudulent charges. Just make sure you pay your full balance off every month. Debit cards won’t let you off the hook.

How can I make sure I don’t lose money in the stock market?

You’re less likely to lose money in the stock market if you own more stocks and you hold them for a long period of time. If you owned an S&P 500 mutual fund that holds the 500 largest company stocks in the U.S., you would have never lost money if you held it for at least 15 years – whether you bought it in 1973, 1983, 1993, or 2003 or any year in between!

What are large-cap, mid-cap, and small-cap stocks?

They’re just fancy names for stocks of large companies, mid-size companies, and small companies.

What is asset allocation?

It’s your mix of stocks, bonds, and cash that controls your risk. If you’re heavy in stocks you’ll have higher risk – you’ll potentially make more money but potentially lose more too. As you add bonds and cash to your mix, you can reduce your risk.

What is interest?

It’s the percentage that you either earn on your savings or pay on your debt. You can earn interest in a savings account, although right now you’re lucky to get 0.5%. On the other extreme, credit cards kill you with their interest rate which average 15.9% in 2021.

What is diversification?

It’s a way to reduce your risk when investing. Rather than going all-in on a single bet, you can buy thousands of stocks and bonds in a mutual fund. This lets you easily bet on the entire world economy, which is almost guaranteed to go up in the long run. Until the Apocalypse.

How does income tax work?

The government collects taxes based on how much money you make but in steps. You pay the least amount at the lowest step, and with each step your income increases, you pay higher taxes for that next chunk of income.

What is rebalancing?

Rebalancing is how you can get your investment portfolio mix back in order. Over time, your mix of stocks, bonds, and cash can drift as each performs differently. Once a year, you’ll want to reset them back to your target mix. A target-date mutual fund does this automatically for you.

What is an emergency fund?

Sh!t happens. Cars break down. Water heaters leak. You lose your job. You need an emergency fund of available cash that you can tap to cover these emergencies. You should shoot to cover six months of living expenses.